What we provide

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

WallStreetCourier is the official source of the Smart Money Flow Index for Bloomberg Professional, trusted by top financial professionals worldwide.

What we provide

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

WallStreetCourier is the official source of the Smart Money Flow Index for Bloomberg Professional, trusted by top financial professionals worldwide.

What we provide

Our research is built on a highly accurate and data-driven framework, backed by decades of practitioner expertise and solid academic literature.

Our all-in-one research platform saves you valuable time. No noise, no extra costs, no endless web searches. Just robust and reliable results delivered with unmatched convenience.

Our research framework follows a clear and structured process, making it easy to learn and apply this proven framework to any market whenever needed.

By eliminating emotion from the equation, sidestep financial headlines. Our research focuses on what truly matters – actionable insights rooted in statistically relevant facts.

WallStreetCourier is the official source of the Smart Money Flow Index for Bloomberg Professional, trusted by top financial professionals worldwide.

What We Do

Philosophy

“The Trend Is Your Friend” – This is a timeless saying on Wall Street for good reason. Identifying and investing in trends remains one of the most profitable investment strategies, supported by decades of practitioner results and robust academic research.

Rather than trying to predict market directions, the key lies in identifying strong emerging trends early and capitalizing on market movements to maximize profits.

Proven Research

Framework

Our research framework goes beyond just simply tracking price movements, which often causes late-in and late-out effects. By systematically analyzing the participation rate of the broader market, including sentiment from smart- and dumb-money positions, our research uncovers emerging trends faster and with greater precision than traditional methods.

These trends are then classified into six predefined market regimes based on their strength and direction, ranging from ‘Very High Reward’ to ‘Very High Risk’. Each market regime has its specific risk-/return profile – providing a clear statistical edge.

Delivering Results

Since 1999

Since 1999, our data-driven research has helped subscribers identify strong emerging trends, distinguish between trend reversals and temporary pauses within broader movements and minimize the risk of unfavorable entry or exit points.

What We Do

Philosophy

“The Trend Is Your Friend” – This is a timeless saying on Wall Street for good reason. Identifying and investing in trends remains one of the most profitable investment strategies, supported by decades of practitioner results and robust academic research.

Rather than trying to predict market directions, the key lies in identifying strong emerging trends early and capitalizing on market movements to maximize profits.

Proven Research

Framework

Our research framework goes beyond just simply tracking price movements, which often causes late-in and late-out effects. By systematically analyzing the participation rate of the broader market, including sentiment from smart- and dumb-money positions, our research uncovers emerging trends faster and with greater precision than traditional methods.

These trends are then classified into six predefined market regimes based on their strength and direction, ranging from ‘Very High Reward’ to ‘Very High Risk’. Each market regime has its specific risk-/return profile – providing a clear statistical edge.

Delivering Results

Since 1999

Since 1999, our data-driven research has helped subscribers identify strong emerging trends, distinguish between trend reversals and temporary pauses within broader movements and minimize the risk of unfavorable entry or exit points.

What We Do

Philosophy

“The Trend Is Your Friend” – This is a timeless saying on Wall Street for good reason. Identifying and investing in trends remains one of the most profitable investment strategies, supported by decades of practitioner results and robust academic research.

Rather than trying to predict market directions, the key lies in identifying strong emerging trends early and capitalizing on market movements to maximize profits.

Proven Research Framework

Our research framework goes beyond just simply tracking price movements, which often causes late-in and late-out effects. By systematically analyzing the participation rate of the broader market, including sentiment from smart- and dumb-money positions, our research uncovers emerging trends faster and with greater precision than traditional methods.

These trends are then classified into six predefined market regimes based on their strength and direction, ranging from ‘Very High Reward’ to ‘Very High Risk’. Each market regime has its specific risk-/return profile – providing a clear statistical edge.

Delivering Results Since 1999

Since 1999, our data-driven research has helped subscribers identify strong emerging trends, distinguish between trend reversals and temporary pauses within broader movements and minimize the risk of unfavorable entry or exit points.

What we offer

We offer four tailored research services designed to meet the needs of all investors, from profit-driven swing traders to long-term buy-and-hold investors

Daily Market Research:

Market Insights:

Predictive Indicators:

ETF Model Portfolios:

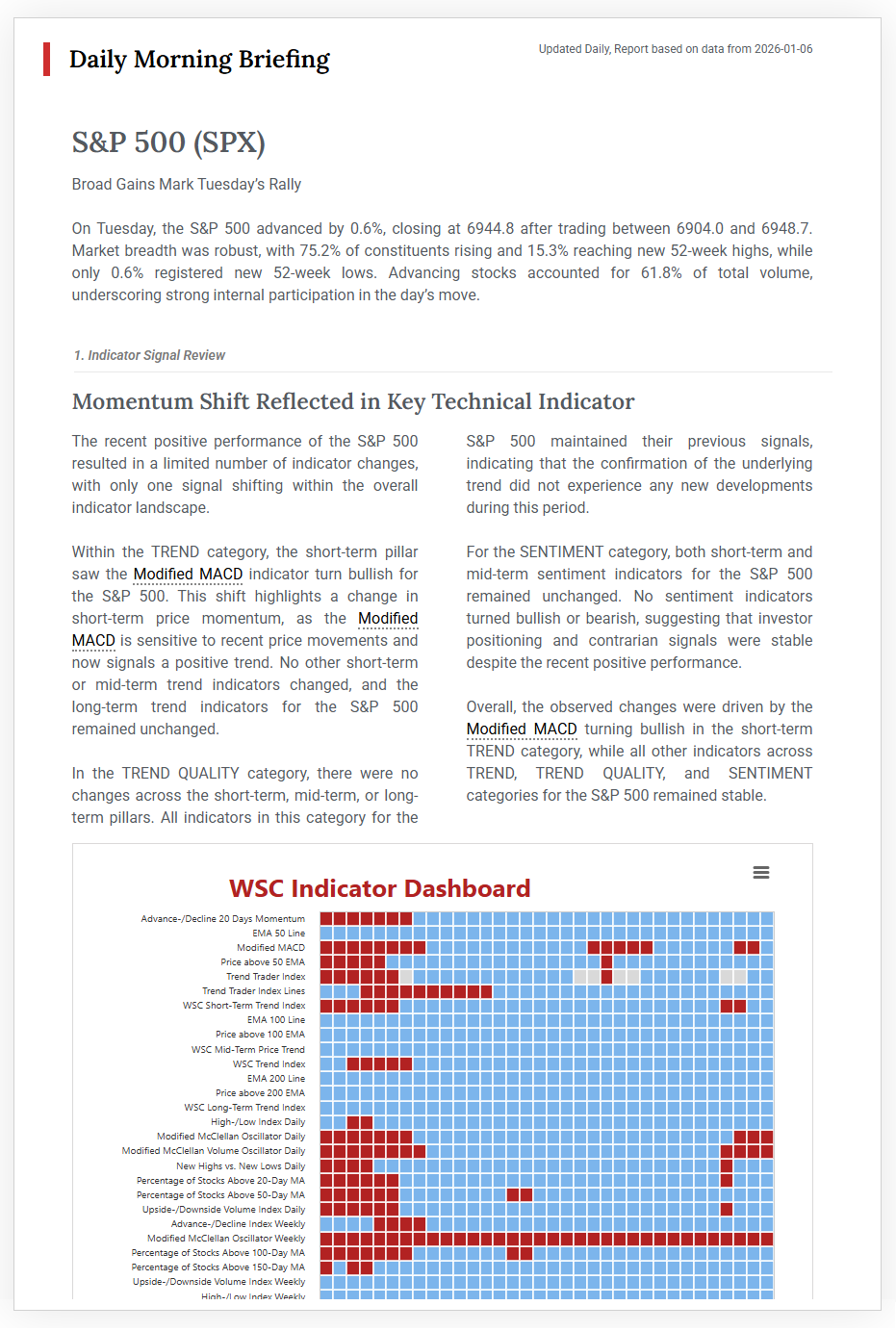

The Daily Morning Briefing: Your Most Profitable 15 Minutes of the Day

Before markets open, the Daily Morning Briefing provides a clear, structured view of current market conditions. Instead of reacting to headlines or overnight moves, investors see whether price action is supported by healthy internals or driven by short-term noise.

Each morning, the briefing evaluates trend, trend quality, and sentiment across multiple time horizons and translates dozens of indicators into intuitive Market Health scores and market regime signals. The result is a disciplined framework that helps investors stay aligned with opportunity, manage risk more confidently, and make informed decisions before the trading day begins.

*) For 28 markets (SPX, NDQ, NYSE, RUT, TSX, DAX, CAC 40, FTSE, IBEX, STOXX 600, MIB, NIKKEI, ASX 200, CSI 300, HSI, EM, XLC, CLY, XLP, XLE, XLF, GDX, XLV, XLI, XLB, XLRE, XLK, XLU)

**) For 28 markets plus the MSCI World

***) For 38 futures markets

****) Covering major market indces: DJIA, SPX, DAX, CAC, IBEX, HSI …

Daily Market Research:

Market Insights:

*) For 28 markets (SPX, NDQ, NYSE, RUT, TSX, DAX, CAC 40, FTSE, IBEX, STOXX 600, MIB, NIKKEI, ASX 200, CSI 300, HSI, EM, XLC, CLY, XLP, XLE, XLF, GDX, XLV, XLI, XLB, XLRE, XLK, XLU)

**) For 28 markets plus the MSCI World

***) For 38 futures markets

****) Covering major market indces: DJIA, SPX, DAX, CAC, IBEX, HSI …

Predictive Indicators:

ETF Model Portfolios:

The Daily Morning Briefing: Your Most Profitable 15 Minutes of the Day

Before markets open, the Daily Morning Briefing provides a clear, structured view of current market conditions. Instead of reacting to headlines or overnight moves, investors see whether price action is supported by healthy internals or driven by short-term noise.

Each morning, the briefing evaluates trend, trend quality, and sentiment across multiple time horizons and translates dozens of indicators into intuitive Market Health scores and market regime signals. The result is a disciplined framework that helps investors stay aligned with opportunity, manage risk more confidently, and make informed decisions before the trading day begins.

Daily Market Research:

Market Insights:

Predictive Indicators:

ETF Model Portfolios:

*) For 28 markets (SPX, NDQ, NYSE, RUT, TSX, DAX, CAC 40, FTSE, IBEX, STOXX 600, MIB, NIKKEI, ASX 200, CSI 300, HSI, EM, XLC, CLY, XLP, XLE, XLF, GDX, XLV, XLI, XLB, XLRE, XLK, XLU)

**) For 28 markets plus the MSCI World

***) For 38 futures markets

****) Covering major market indces: DJIA, SPX, DAX, CAC, IBEX, HSI …

The Daily Morning Briefing: Your Most Profitable 15 Minutes of the Day

Before markets open, the Daily Morning Briefing provides a clear, structured view of current market conditions. Instead of reacting to headlines or overnight moves, investors see whether price action is supported by healthy internals or driven by short-term noise.

Each morning, the briefing evaluates trend, trend quality, and sentiment across multiple time horizons and translates dozens of indicators into intuitive Market Health scores and market regime signals. The result is a disciplined framework that helps investors stay aligned with opportunity, manage risk more confidently, and make informed decisions before the trading day begins.

(no credit card required)

You are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationFREE MARKET RESEARCH

Only This Weekend!

14 Mar. 12:00 PM – 17 Mar. 12:00 PM (CET)

No Credit Card Needed

This weekend, all our free members with a Basic plan will have full access to premium content.

FREE MARKET RESEARCH

Only This Weekend!

14 Mar.. 12:00 PM – 17 Mar. 12:00 PM (CET)

No Credit Card Needed

This weekend, all our free members with a Basic plan will have full access to premium content.