1

Identify Robust Trends

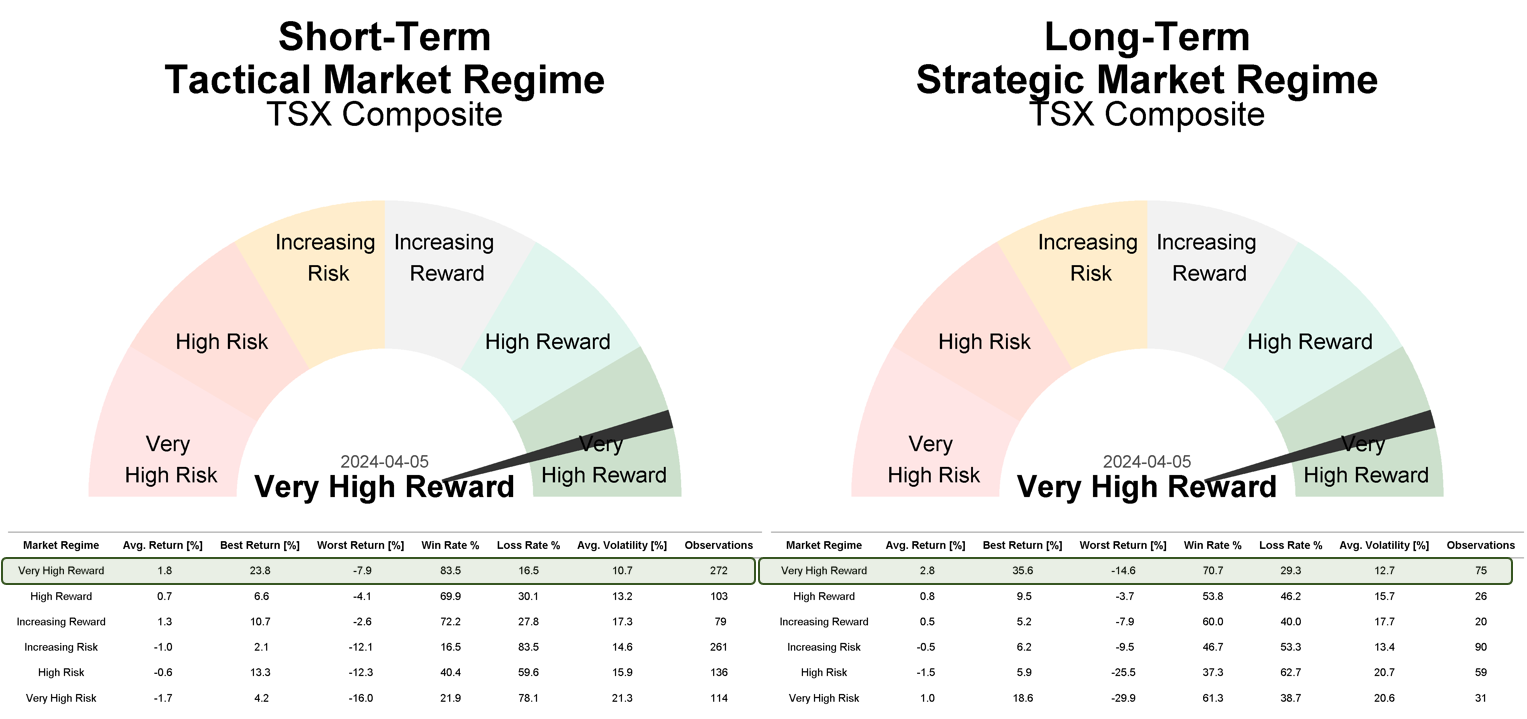

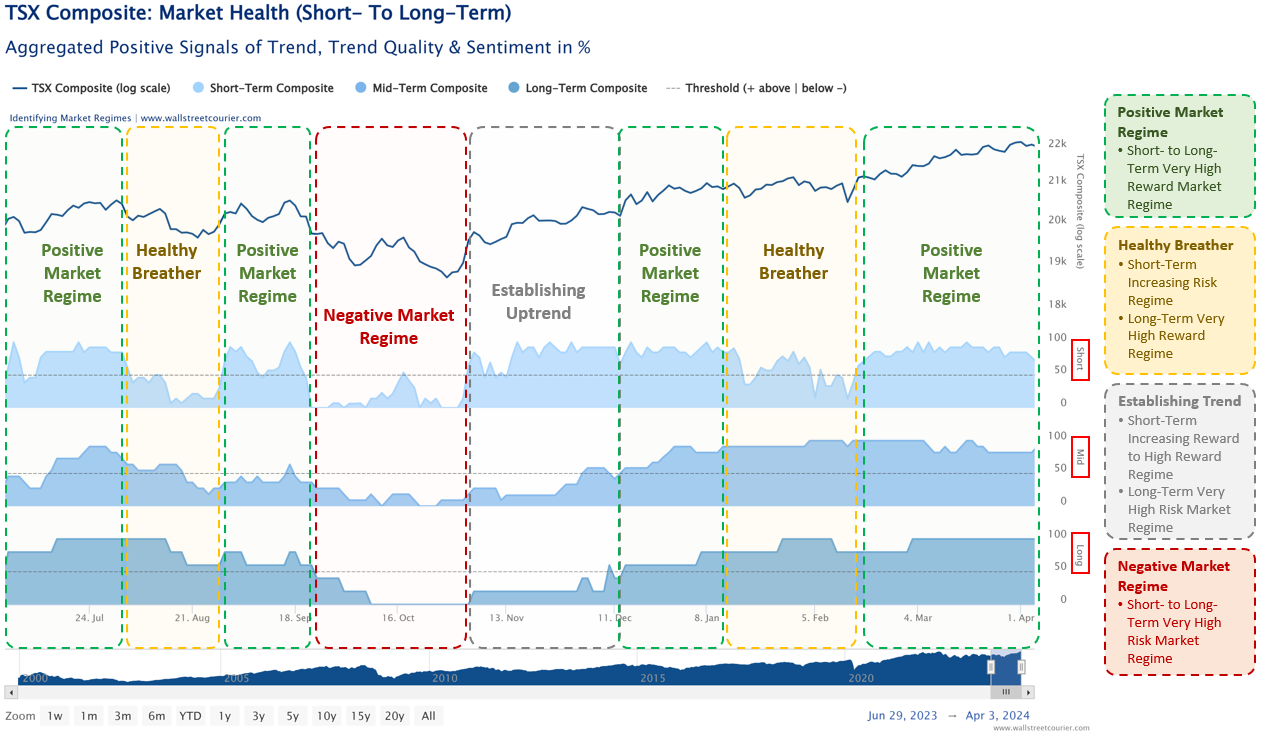

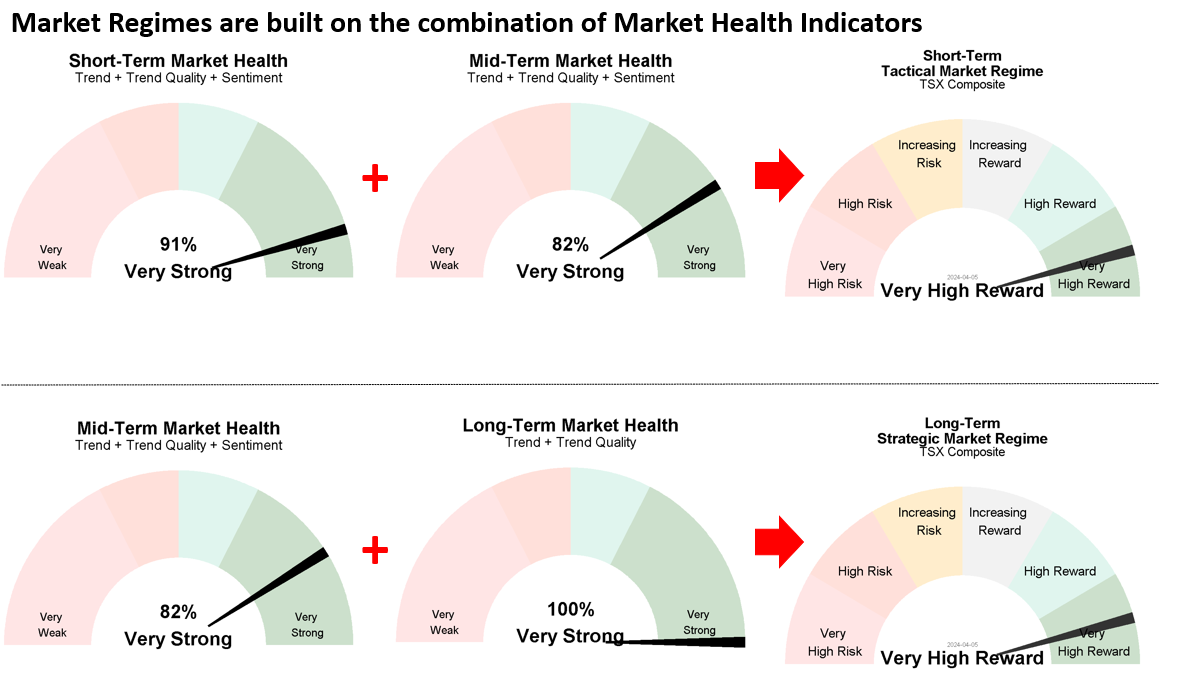

- Trends are measured through a systematic screening of signals from multiple indicators (for example the WSC Trend Index, the Smart Money Flow Index or the Daily Put-/Call Ratio All CBOE Options)

- These indicators cover various categories (trend, trend quality, and sentiment, including dumb- and smart-money positioning) and timeframes.

- This diversified approach minimizes the impact of noise in individual indicators and enables an unbiased and robust view of current market conditions.